Basic Stance on Corporate Governance

Our group operates an ICT service business based on the philosophy of "Information Revolution - Happiness for everyone - Technologies Design the Future -" We aim to achieve sustainable growth and increase corporate value over the medium to long term by striving for appropriate collaboration with various stakeholders, including shareholders, and contributing to the realization of a prosperous information society. To this end, it is essential to have an appropriate system in place for transparent, fair, prompt, and decisive decision-making, and we will continue to work to improve our corporate governance.

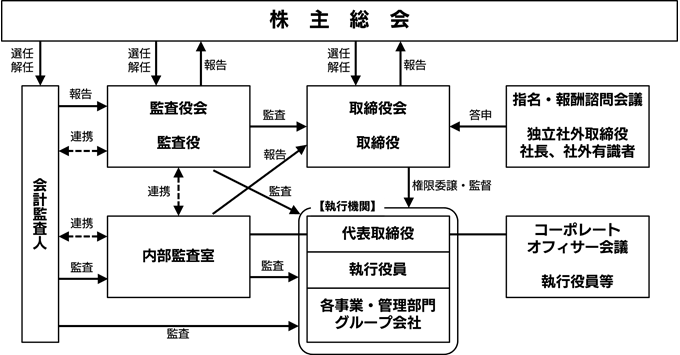

Outline of Corporate Governance Structure

In accordance with the Companies Act, our company has established a board of directors and Corporate Auditor, and has adopted an executive officer system. Our current management structure consists of nine directors, ten executive officers (three of whom also serve as directors), and four Corporate Auditor. Our articles of incorporation stipulate that the number of directors will be nine or less, and that their term of office will be one year.

In order to ensure sound, transparent and objective management, the majority of our board of Corporate Auditor are independent outside directors. We have three outside Corporate Auditor, who monitor management from an independent perspective.

The Corporate Officers' Meeting has been established to play an important role in our corporate governance system. In principle, the Corporate Officers' Meeting is held every week, where executive officers discuss issues in daily business activities and business strategies. In addition, at consolidated subsidiaries, our executive officers discuss management issues as directors and Corporate Auditor, thereby ensuring that the entire group's corporate governance is understood and implemented thoroughly.

Furthermore, at the Board of Directors meeting held on June 20, 2022, the Company resolved to change the name of the Remuneration Advisory Council, which previously deliberated on the remuneration system and levels for directors, to the "Nomination and Remuneration Advisory Council" and to change its role, authority, and composition in order to further ensure the transparency and fairness of the Company's decision-making. In addition to the previous deliberations, the council will also deliberate on the appointment and dismissal of directors. In addition, an independent outside director will serve as chairperson, and independent outside directors will make up the majority of the council's members.

The status of the accounting audit is as follows:

Name of the audit firm

Deloitte Touche Tohmatsu LLC

b. Continuous audit period

Since 1997

c. The certified public accountant who performed the work

Mr. Koji Ishikawa and Mr. Junichi Fujii

d. Composition of assistants involved in audit work

The accounting audit work of our company is assisted by six certified public accountants and 21 other personnel.

e. Policy and reasons for selecting audit firms

Based on the results of the audit firm's evaluation by Corporate Auditor Board described in f. below, the Company has confirmed the audit quality and independence and decided to reappoint Tohmatsu LLC. If the Corporate Auditor Board deems it necessary, such as when there is an impediment to the accounting auditor's performance of duties, it will decide on the content of a proposal to submit to the General Meeting of Shareholders regarding the dismissal or non-reappointment of the accounting auditor. If the accounting auditor falls under any of the items set out in Article 340, Paragraph 1 of the Companies Act, the accounting auditor will be dismissed with the consent of all Corporate Auditor. In this case, Corporate Auditor selected by Corporate Auditor Board will report the dismissal of the accounting auditor and the reasons therefor at the first General Meeting of Shareholders convened after the dismissal.

f. Evaluation of the audit firm by Corporate Auditor and the board of Corporate Auditor

Our Corporate Auditor receives reports from the business execution divisions that are being audited, and also hears from the auditing firm about the results of inspections by supervisory authorities and the firm's internal quality control system. In addition, the Board of Auditors evaluates the auditing firm after comprehensively considering whether the audit quality is being maintained and appropriate audits are being conducted by attending audit sites, etc.

Corporate Governance Structure

Matters related to Organizational structure/management

| Organizational Structure | Company with Audit & Supervisory Board |

|---|

■Board of Directors

| Number of directors according to the articles of incorporation | 9 people |

|---|---|

| Term of office of directors according to the articles of incorporation | 1 year |

| chairman of the board of directors | president |

| Number of directors | 9 people |

| Election status of External Board of Director | Elected |

| Number of External Audit & Supervisory Board Member | Five people |

| Number of elected independent executive in External Audit & Supervisory Board Member | Five people |

■Audit & Supervisory Board members

| Audit & Supervisory Board setting or not | Setting |

|---|---|

| Fixed Number of Audit & Supervisory Board members | 4 people |

| Number of Audit & Supervisory board Members | 4 people |

| Election status of External Audit & Supervisory Board Member | Elected |

| Number of External Audit & Supervisory Board Member | 3 people |

| Number of elected independent executive in External Audit & Supervisory Board Member | 3 people |

■Independent officer

| Name Title | post | Reason for election of Independent executive |

|---|---|---|

| Shigeo Suzuki | External Member of the Board | With his extensive experience and wide-ranging knowledge in corporate management, he supervises the Company's management, attends the Compensation Advisory Council, which deliberates on the remuneration of directors, and supervises the management team by reflecting the evaluation of the Company's performance, etc. in the remuneration from an independent and objective standpoint. We have appointed him as an outside director in order to strengthen the supervisory function of business execution by receiving advice based on his wide-ranging experience and knowledge in the IT industry, and to receive useful advice based on his extensive knowledge on business operations and the newly shifted divisional system. Mr. Shigeo Suzuki was in charge of operations at Softbank BB Corp. (currently SB C&S Corp.), a sister company of our company, until 2005, but a considerable amount of time has passed since he left his former company, and he has been acting independently during that time, so we believe that he is not in a position to be influenced by the intentions of his former company. In addition, he does not have any attributes that would raise doubts about his independence from our company, so we have determined that there is no risk of a conflict of interest with general shareholders and have designated him as an independent director. |

| Yoshie Munakata | External Member of the Board | With his extensive experience and wide-ranging knowledge in corporate management, he supervises the Company's management, attends the Compensation Advisory Council, which deliberates the remuneration of directors, and supervises the management team by reflecting the evaluation of the Company's performance, etc. in remuneration from an independent and objective standpoint. He has been appointed as an outside director in order to strengthen the supervisory function for business execution and to receive useful advice on business operations by utilizing his wide-ranging experience in semiconductors used in IoT devices and the provision of knowledge and advice on the Company's evolution into a service provider. In addition, since Yoshie Munakata does not have any attributes that would raise doubts about his independence from the Company, we have determined that there is no risk of a conflict of interest with general shareholders and have therefore designated him as an independent director. |

| Yukari Tominaga | External Member of the Board | She has a wide range of knowledge and experience, including experience as an engineer and abundant experience in corporate management. Based on her experience as Chief Diversity Officer in her previous job, she has been appointed as an outside director to oversee the management of the Company, including the realization of diversity, including the active participation of women, and sustainability measures, as well as to strengthen the supervisory function for business execution and to receive useful advice regarding business operations. In addition, since there are no attributes that would call into question Ms. Tominaga's independence from the Company, we have determined that there is no risk of a conflict of interest with general shareholders, and have therefore appointed her as an independent director. |

| Yuka Miyagawa | External Member of the Board | She has a wide range of knowledge and experience, combining experience in sales and marketing in the IT industry with ample experience in corporate management. She has also been active in holding seminars on the necessity of diversity in the workplace, and we have appointed her as an outside director to oversee our management, including the realization of diversity, including the active participation of women, and sustainability, as well as to strengthen the supervisory function for business execution and to receive useful advice on business operations. In addition, since there are no attributes regarding Ms. Yuka Miyagawa that would call into question her independence from our company, we have determined that there is no risk of a conflict of interest with general shareholders, and have therefore appointed her as an independent director. |

| En Sawa | External Member of the Board | Starting out as an engineer, he gained experience in general management at a global IT company, and recently has worked as a corporate advisor, applying his wide-ranging knowledge and experience in areas such as security advisory, engineer management, and human resource development. He has been appointed as an outside director to oversee the Company's management based on his wide-ranging knowledge and predictions about the latest trends in the global IT field and localizing them in Japan, as well as to strengthen the supervisory function for business execution and to receive useful advice on business operations. In addition, since there are no attributes that would raise doubts about Mr. Sawa's independence from the Company, we have determined that there is no risk of a conflict of interest with general shareholders, and have therefore appointed him as an independent director. |

| Mitsumasa Ueno | Corporate Auditor | We elected him as an External Audit & Supervisory Board member to reflect his specialized knowledge of finance and accounting and his vast experience gained as a certified public accountant in our corporate audit from an independent standpoint. In addition, he meets the requirements for independence stipulated by the Tokyo Stock Exchange and judging that there is no risk of a conflict of interest arising between him and general shareholders, we designated him as an Independent Officer. |

| Michiaki Nakano | Corporate Auditor | We elected him as an External Audit & Supervisory Board member to reflect his specialized knowledge of corporate legal affairs and his vast experience gained as a lawyer in our corporate audit from an independent standpoint. In addition, he meets the requirements for independence stipulated by the Tokyo Stock Exchange and judging that there is no risk of a conflict of interest arising between him and general shareholders, we designated him as an Independent Officer. |

| Yoji Murohashi | Corporate Auditor | We elected him as an External Audit & Supervisory Board member to reflect his specialized knowledge of finance and accounting and his vast experience gained as a certified public accountant in our corporate audit from an independent standpoint. In addition, he meets the requirements for independence stipulated by the Tokyo Stock Exchange and judging that there is no risk of a conflict of interest arising between him and general shareholders, we designated him as an Independent Officer. |

Board Effectiveness Assessment

■Implementation of effectiveness evaluation of the Board of Directors

In order to further ensure its effectiveness and improve its functions, the Company's Board of Directors will analyze and evaluate its effectiveness once a year between January and March. A survey is conducted for all directors and Corporate Auditor, and the survey responses are collated and analyzed with advice from a third party. The results are shared with the Board of Directors, and a self-evaluation is conducted and disclosed.

The method and results of the evaluation of the effectiveness of our Board of Directors for fiscal year 2023 are outlined below.

The Company will strive to further improve the effectiveness of the Board of Directors by continuing to evaluate its effectiveness.

■Evaluation method

(1) Evaluation subjects: Representative Director (1 person), Directors (3 people), Outside Directors (5 people), Corporate Auditor (4 people)

(2) Method: Questionnaire and interviews

(3) Implementation period: January to March 2024

■Summary of evaluation results

Summary

Based on the results of the previous evaluation, the Company's Board of Directors has assessed that there has been significant improvement and that steady efforts are being made on the themes that were identified as issues, such as the appropriateness of discussions on succession plans and support for training opportunities.

Additionally, the majority of respondents considered the number and ratio of inside and outside directors to be appropriate, and the appropriateness of the composition of the Board of Directors was evaluated as one of the strengths of our Board of Directors.

The majority of directors are outside directors, and as a result, the Board of Directors has been evaluated as having a strong supervisory function, with lively discussions based on appropriate meeting management, and its effectiveness being fully ensured, as was the case last year.

Derived issues

・Lack of discussion regarding nominations and remuneration

・Setting the right agenda

・Relationships with shareholders and investors

The need to address the above issues in order to further enhance effectiveness was recognized, and it was confirmed that these will be addressed in the operation of the Board of Directors in fiscal 2024.

We will continue to work to improve effectiveness, taking into account our goals and the business environment.

Remuneration of Officers

Basic Policy

Our basic policy is to create a compensation system that provides incentives for sustainable growth and improvement of corporate value over the medium to long term. Specifically, executive directors' remuneration consists of basic remuneration as fixed remuneration, executive bonuses as short-term performance-linked remuneration, and stock remuneration as medium-term performance-linked remuneration, and they monitor and supervise management from an independent standpoint. In consideration of their roles, external directors who are responsible for these functions receive only basic remuneration. Please note that remuneration for directors whose primary duty is to serve as officers of subsidiaries and group companies is paid by the subsidiary and group company, and is determined based on each company's remuneration policy.

For details, please refer to the business report in the "Notice of Convocation of General Meeting of Shareholders."

https://www.softbanktech.co.jp/corp/ir/event/shareholders/

Total amount of remuneration for directors and Corporate Auditor (FY2023)

Please scroll left and right to view.

| Classification | Total amount of remuneration (1 million yen) | Total amount of compensation by type (One million yen) |

Number of eligible officers (Persons) |

|||

|---|---|---|---|---|---|---|

| Basic remuneration | Performance-linked compensation, etc. | |||||

| Stock compensation | Others | Officer bonus | Non-monetary compensation | |||

| Stock compensation | ||||||

| Member of the Board (of which External Members of the Board) |

207 (41) |

131 (41) |

7 (ー) |

56 (-) |

11 (-) |

8 (5) |

| Audit & Supervisory Board Member (of which External Audit & Supervisory Board Members) |

18 (18) |

18 (18) |

0 (0) |

ー (ー) |

ー (ー) |

3 (3) |

- (note)

- 1. The above number of recipients does not include two directors and one Corporate Auditor who receive no compensation.

- 2. The amount of remuneration for directors does not include the employee salary of directors who also serve as employees.

- 3. The amount of remuneration, etc. for Outside Directors includes remuneration as members of the Special Committee established on February 17, 2024.

- 4. Other details of basic remuneration, etc. will consist of the amount equivalent to the company's share of the cost of company housing provided to directors.

- 5. Bonuses are paid to directors as performance-linked remuneration, etc. The trend in operating income, including the current fiscal year, is as stated in "1. Current Status of the Group (Corporate Group) (1) Overview of Business Results."

- 6. Stock compensation is granted as performance-linked compensation and non-monetary compensation. The amount of expenses recorded during the current fiscal year for compensation for the grant of stock acquisition rights and restricted stock granted as stock options, which are expensed over multiple years, is stated in the stock compensation. The details and grant status of the stock compensation are as described in "2. Current Status of the Company (1) Status of Stocks" and "2. Current Status of the Company (2) Status of Stock Acquisition Rights, etc." In addition, the details and grant status of the restricted stock issued by the Company based on the resolution of the Board of Directors held on June 20, 2022 are as follows:

| Type and number of shares | 15,000 common shares of the Company |

|---|---|

| Issue price | 2,172 yen per share |

| Total Issue Amount | 32,580,000 yen |

| Persons to whom shares will be allocated and their number | Directors (excluding outside directors): 3 Employees: 9 |

| Payment due date | July 20, 2022 |

Risk Management (Business Continuity Planning)

Our group's services mainly utilize IT infrastructure in the Tokyo area to provide services to customers, but if the infrastructure that supports the IT infrastructure stops working (for example, power outage, data communication line disruption, difficulty in securing personnel) ), it will be difficult to continue the service. In addition, if it becomes difficult to go out due to a pandemic or other reason, it will be difficult to provide 24-hour, 365-day monitoring services and system operation and maintenance services that involve physical work at customer locations. Our group has established a business continuity plan and is working to secure uninterrupted data centers, redundant communication lines, and prepare equipment that allows working from home in order to respond to anticipated emergencies. We have set priorities based on this and are preparing measures such as adopting a contract format that reduces some services and provides them on an ongoing basis.

Shareholdings

■ Number of stocks and balance sheet amount

Number of stocks (stocks) |

Total balance sheet amount (million yen) |

|

| Unlisted stocks | 8 |

618 |

| Stocks other than non-information stocks | 1 |

146 |

■ Information on the number of shares, balance sheet amounts, etc. for each stock of specific investment shares and deemed holding shares

| Brand | Number of shares Balance sheet amount (million yen) |

Purpose of holding, summary of business alliance, etc. Quantitative holding effect and reasons for increase in number of shares |

|---|---|---|

| My Farm, Inc. Co., Ltd. | 100,000 |

Although it is difficult to state a quantitative effect of the holding, we have held the shares in order to maintain and strengthen the partnership, with the aim of increasing our competitiveness in the agricultural market by combining the agricultural technology and know-how possessed by REDEN Corp. Co., Ltd. and our subsidiary, Riden Co., Ltd. After examining the matter, we have determined that it will take time to establish a quantitative effect in the agricultural business, but that it is necessary to continue to maintain and strengthen the partnership in order to develop the agricultural business, and therefore we intend to continue holding the shares. The increase in the number of shares is due to a stock split. |

Deemed shareholdings

Not applicable.

Related Links

Articles of Incorporation (274K)

Corporate Governance Report (557K)

Internal Control Report (15K)

Independent Director Notification Form (157K)

Criteria for Determining the Independence of Outside Directors (107K)