ActCall Group's Insight, SoftBank Technology, and Sibira start joint development

SoftBank Technology Corp.

Insight Co., Ltd.

Sibilla Co., Ltd.

Insight Co., Ltd. (Shinjuku-ku, Tokyo, President and CEO: Yasushi Fukuchi, hereinafter referred to as “Insite”) operates a payment solution business within the Act Call Group, SoftBank Technology Corp. (Tokyo) provides ICT services centered on the cloud. Shinjuku-ku, Tokyo, President and CEO: Shinichi Ata (hereinafter referred to as "SBT"), Sibilla Co., Ltd. (Headquarters: Nishi-ku, Osaka, President and CEO: Takashi Fujii, hereinafter referred to as "Sibilla"), which has high technological capabilities in the blockchain field. We are pleased to announce that the three companies will jointly develop a new credit information platform that utilizes blockchain technology and payment data.

■Background

With the advancement of information technology, we have entered an era in which large amounts of personal information are stored on the Internet. While it is predicted that the handling of personal information will continue to expand in the future, problems such as system failures, hacking by external criminals, and information leakage and falsification by internal criminals have become social issues. In addition, with the acceleration of the sharing economy, direct transactions between unknown individuals are rapidly increasing, and the credit information of individuals (transaction partners) is expected to become important in order to conduct safe and secure transactions. Due to these changes in the times, it is thought that there is a need not only for credit information that has been managed by traditional organizations such as financial institutions, but also for ``completely new types of information that can be used as credit information'' that are managed by non-financial institutions. Personal information management that ensures higher security, reliability, and traceability is required.

■About new initiatives

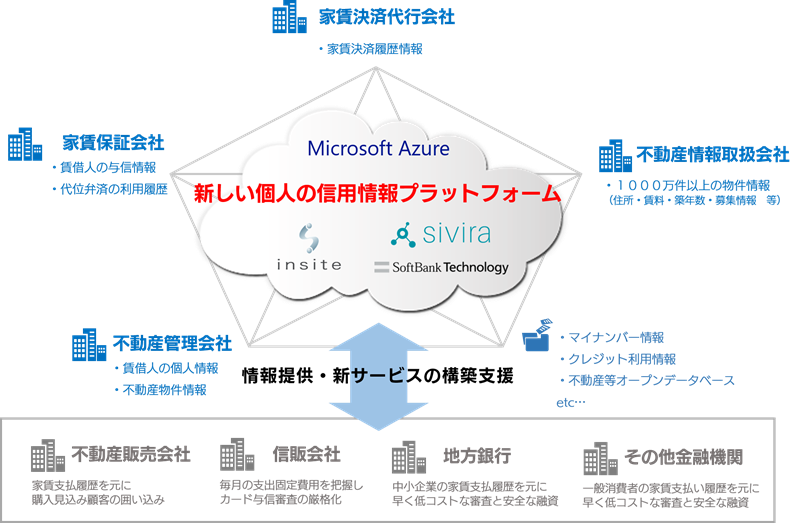

Insight has built a next-generation credit information platform that aggregates and manages multifaceted information by combining the know-how in rent payment agency that Insight has cultivated since its founding, lifestyle payment data such as electricity bills, real estate big data, and blockchain technology. Masu. This will allow users to easily prove their credibility that they have accumulated in their daily lives at any time, allowing them to receive more convenient services. In the first phase of development, scheduled to end at the end of January 2018, we will build a system that utilizes data storage on blockchain and data access using serverless architecture. This makes use of the features of blockchain technology such as tamper resistance, zero downtime, authentication based on encryption technology, data certification using electronic signatures, and data traceability, as well as the redundancy of the cloud, making it safe and secure. Highly available credit information management is achieved.

We have received comments from Microsoft Japan about the development of the credit information platform.

" Microsoft Japan Co., Ltd. welcomes the adoption of Microsoft Azure by Insight, SBT and Sibylla to develop a credit information platform that combines real estate big data and blockchain technology. We hope that this will not only enable the rapid construction of blockchains, but also accelerate the creation of next-generation credit information through data integration and analysis functions. We will continue to work with Insight, SBT, and Sibylla to provide innovative cloud environments that contribute to their customers' digital transformation."

General Manager, Partner Technology Headquarters, Partner Business Headquarters Microsoft Japan Co., Ltd.

Satoshi Hosoi

■Future outlook

In addition to information management, in addition to the payment logs held by Insight, we also integrate real estate data and customer information held by real estate companies nationwide, open data held by the government, My Number information, and web services and mobile applications. We aim to build a new credit economic zone by integrating and analyzing social big data such as usage history and providing next-generation credit information.

■Overview and roles of each company

<Insight>

Insights are ReFintech (*) As a company, we are promoting the lifestyle payment platform concept using the rent payment know-how we have cultivated since our founding. This lifestyle payment platform concept is a business that will contribute to the ITization and revitalization of the real estate industry by developing new services that combine the company's own payment and real estate big data with new technology. We believe that daily life payment data could become the most important data for data mining in the near future, and this initiative is part of this initiative.

(※)ReFinTech

ReFinTech is a coined word from Real Estate Tech (ReTech) and Financial Technology (FinTech). It is a word that describes the service concept that Insight will develop and provide in the future, and we plan to develop services using IT, such as new payment methods for rent and other payments, to improve convenience in the real estate industry.

<SBT>

SBT implements blockchain technology in the cloud and provides stable operational services by leveraging the high technical capabilities and operational know-how of Microsoft Azure. SBT has won numerous awards at partner awards sponsored by Microsoft Japan and Microsoft Corporation, and is a company that is highly evaluated as a partner company for its cloud development know-how, technical capabilities, and implementation track record.

<Sibilla>

Sibilla is conducting research and development of "blockchain technology" that uses advanced mathematical theory to create cryptographic techniques, consensus-building algorithms, and decentralized technology to ensure that information cannot be tampered with and has zero downtime. Sibilla is a company that has received high praise for its blockchain-related technology, including being selected as one of the 27 startup companies promoting innovation at the "EY Innovative Startup 2017" sponsored by Ernst & Young SinNihon LLC.

■About the platform

The blockchain uses "Broof", which was developed by Sibilla. Broof is a blockchain technology developed by Sibilla that aims to use blockchain in areas other than fintech. A flexible smart contract with high robustness, performance, and traceability that can be applied to the enterprise domain. (*) It also enables the execution of

This platform uses Microsoft Azure built by SBT. This makes it possible not only to create a global redundancy configuration utilizing 36 regions around the world, but also to create a disaster recovery configuration in two domestic regions, achieving extremely high geographic redundancy.

Additionally, in the future, we will integrate and analyze a wide variety of data by collaborating with Azure Machine Learning and Cognitive Services to create next-generation credit information.

(※)Smart contract

Electronic contracts, agreements, transactions, etc. that are guaranteed to be executed automatically even without the presence of a specific administrator. This is often achieved using blockchain technology, which makes it impossible to tamper with the contracts defined and ensures that they are executed without human intervention.

Contact information for inquiries from media regarding this matter

○ SoftBank Technology Corp. Corporate Planning Department Corporate Communication Group

Email: sbt-pr@tech.softbank.co.jp